Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

D

Deleted member 2197

Guest

NVIDIA To Launch More Powerful GeForce RTX 4080 Ti GPU In Early 2024 At Same Price As RTX 4080

NVIDIA is rumored to launch its more powerful GeForce RTX 4080 Ti GPU in early 2024 within a similar price range as the RTX 4080.

DegustatoR

Legend

With how prices are on 7900 cards they don't really have other choice than to drop 4080's and add something in its place.

NVIDIA To Launch More Powerful GeForce RTX 4080 Ti GPU In Early 2024 At Same Price As RTX 4080

NVIDIA is rumored to launch its more powerful GeForce RTX 4080 Ti GPU in early 2024 within a similar price range as the RTX 4080.wccftech.com

I think Nvidia are well prepared to cut prices on the 4080. It's one of the most absurdly overpriced GPU's of all-time, and I'm still completely gobsmacked they had the gall to even launch it like that. It's an upper-midrange 379mm² GPU that's like 10% cut down. It's basically what the 3070 was in the Ampere lineup. I think its main role was to encourage reception and sales of the flagship 4090(which itself is really more equivalent to a 3080Ti than the 3090 in Ampere terms).With how prices are on 7900 cards they don't really have other choice than to drop 4080's and add something in its place.

This left them plenty of room to eventually reduce prices on the 4080 to something still completely ridiculous like $900-1000, while slotting in either a fully enabled AD103 part or a more cut down AD102 part as a 4080Ti at the previous $1200+ price point. And then they get showered with praise for lowering prices and delivering 'better value', while really only taking things from 'oh my god you cant be serious' to simply 'terrible'. It's such easy PR, cuz gamers are generally easily exploited fools.

Still very salty about how bad RDNA3 is. With Nvidia gone mad with greed, AMD was our only chance to keep the marketplace competitive, and AMD flubbed it at the worst possible time with one of the most disappointing architectures they've ever produced. smh

DegustatoR

Legend

Ah, yes, gone mad with greed so much that it forced nearly all RDNA3 cards to sell below their MSRPs now.With Nvidia gone mad with greed

Nvidia didn't force this by creating such 'good value' parts, ffs. You know this perfectly well but you will say ANYTHING to defend Nvidia. Literally anything.Ah, yes, gone mad with greed so much that it forced nearly all RDNA3 cards to sell below their MSRPs now.

DegustatoR

Legend

Right, because there are so many better value parts on the market from every IHV.Nvidia didn't force this by creating such 'good value' parts, ffs. You know this perfectly well but you will say ANYTHING to defend Nvidia. Literally anything.

We've been over this. Your inability to see past your own fantasies doesn't mean that I will say anything bla bla bla.

Just because there might not be better doesn't make the one there is good. No-one is that naive.Right, because there are so many better value parts on the market from every IHV.

We've been over this. Your inability to see past your own fantasies doesn't mean that I will say anything bla bla bla.

Just because there might not be better doesn't make the one there is good. No-one is that naive.

I think his point is that Nvidia isn’t the only company “gone mad with greed” so why point the finger at them?

Because they're the ones primarily driving it? And have certainly taken it to a much greater extreme than anybody else. This should be plainly obvious.I think his point is that Nvidia isn’t the only company “gone mad with greed” so why point the finger at them?

They have literally raised the prices compared to last generation equivalent parts by over 100% for almost all of the Lovelace range. It's absolutely insane. Nobody else is doing anything like that and it's shocking to me how people here try and defend, downplay or distract from it.

Because they're the ones primarily driving it? And have certainly taken it to a much greater extreme than anybody else. This should be plainly obvious.

They have literally raised the prices compared to last generation equivalent parts by over 100% for almost all of the Lovelace range. It's absolutely insane. Nobody else is doing anything like that and it's shocking to me how people here try and defend, downplay or distract from it.

In a competitive market if one player is being greedy the others will undercut and still make a healthy profit. Nobody is defending anything, just pointing out that the ongoing evil Nvidia narrative is a fairy tale.

DavidGraham

Veteran

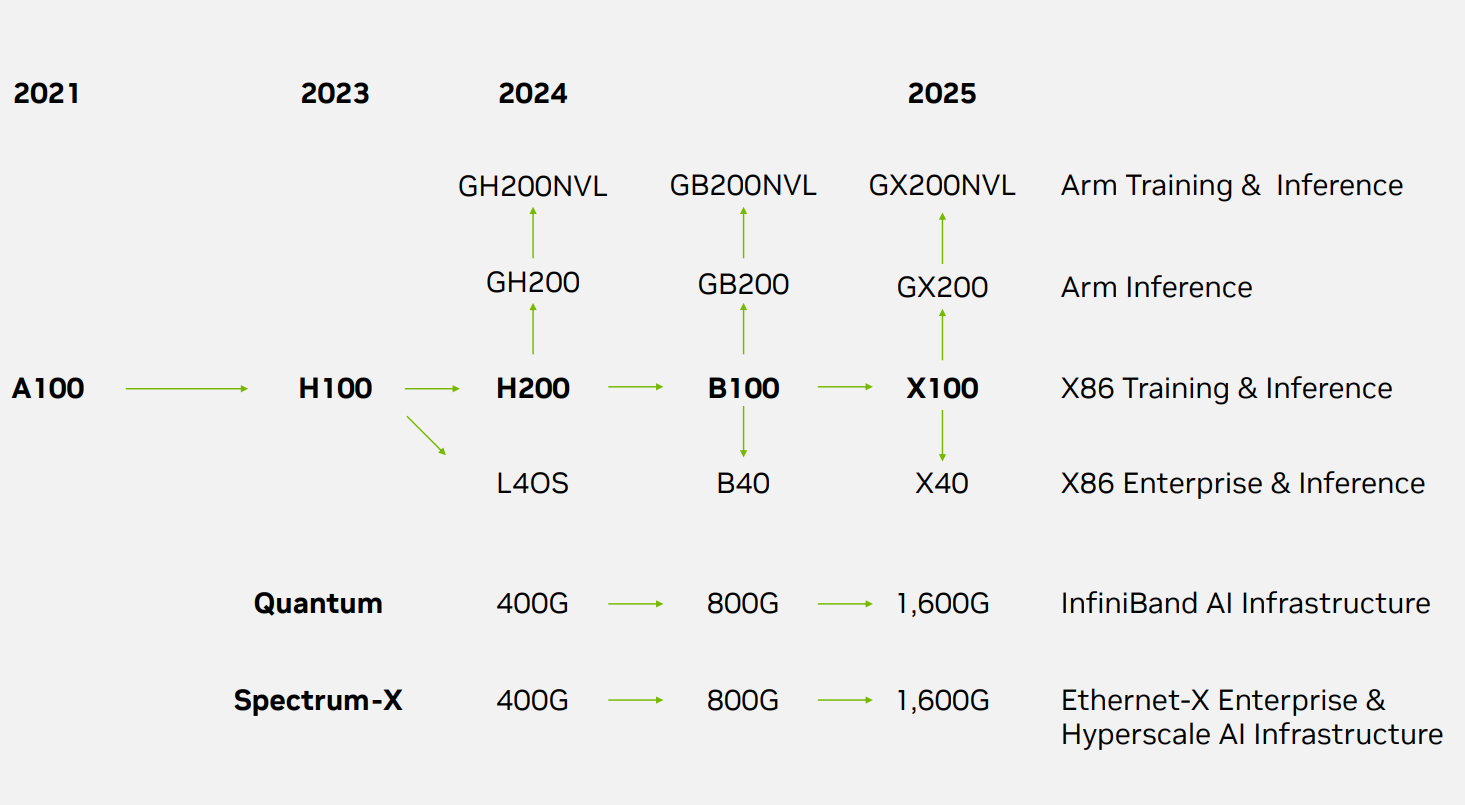

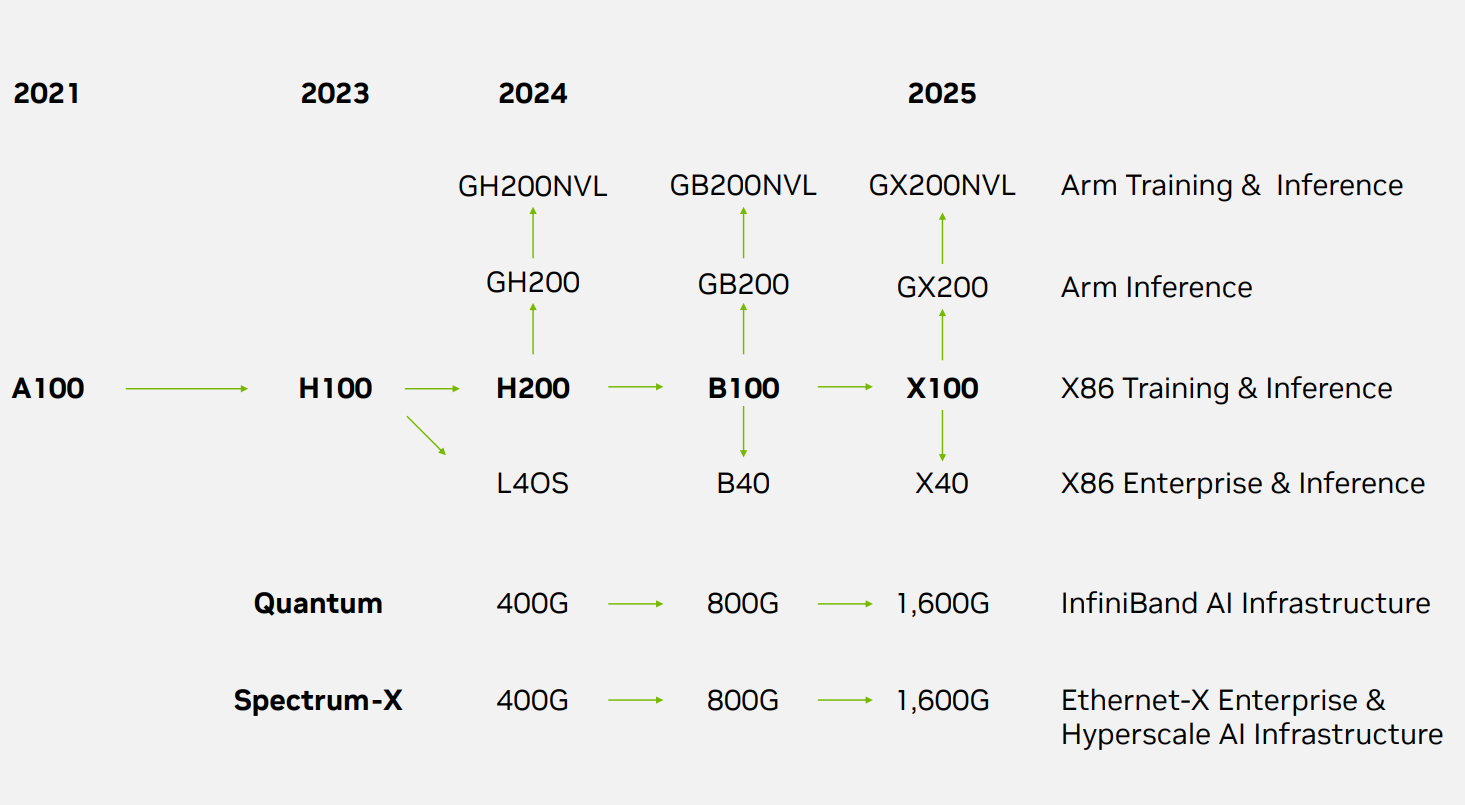

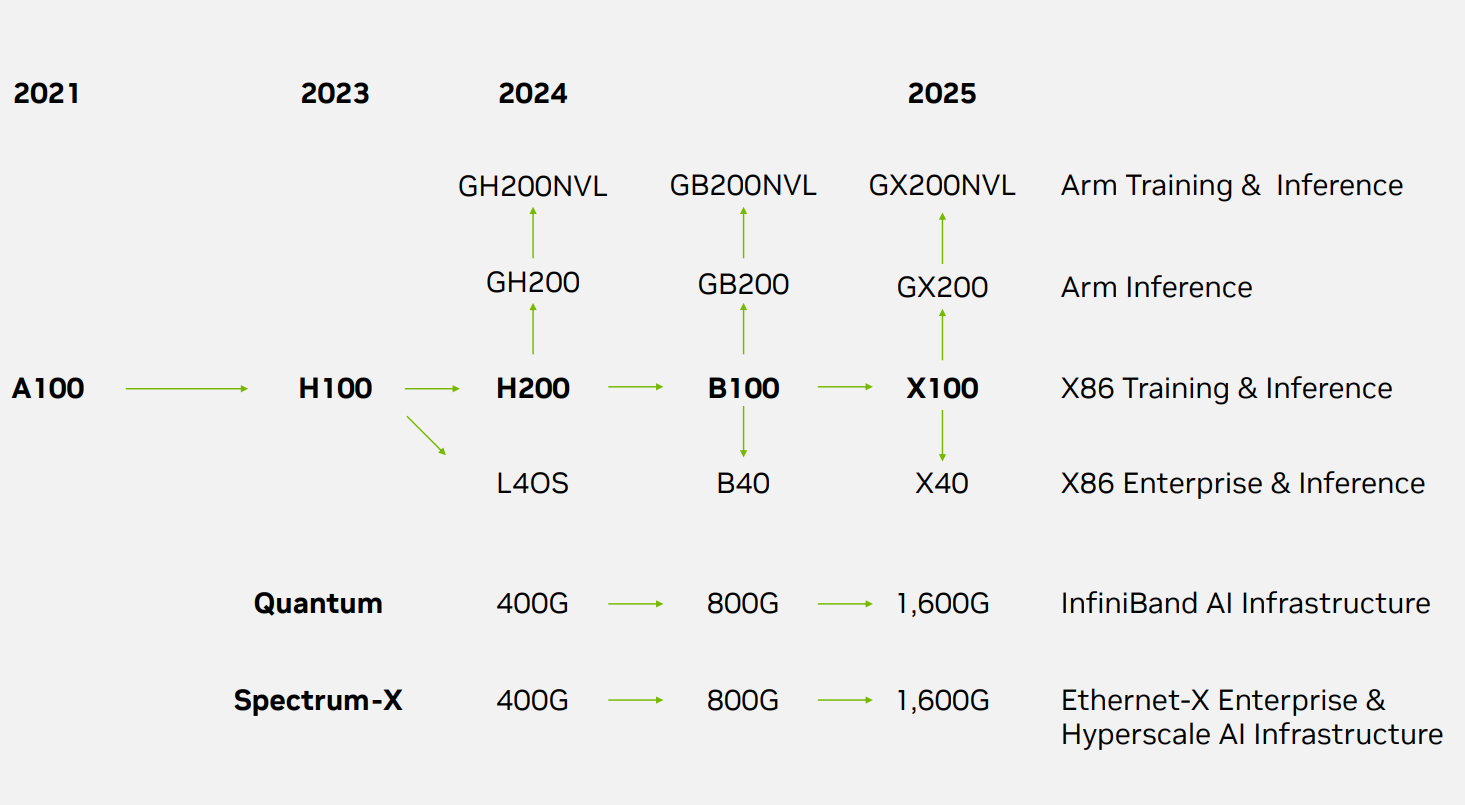

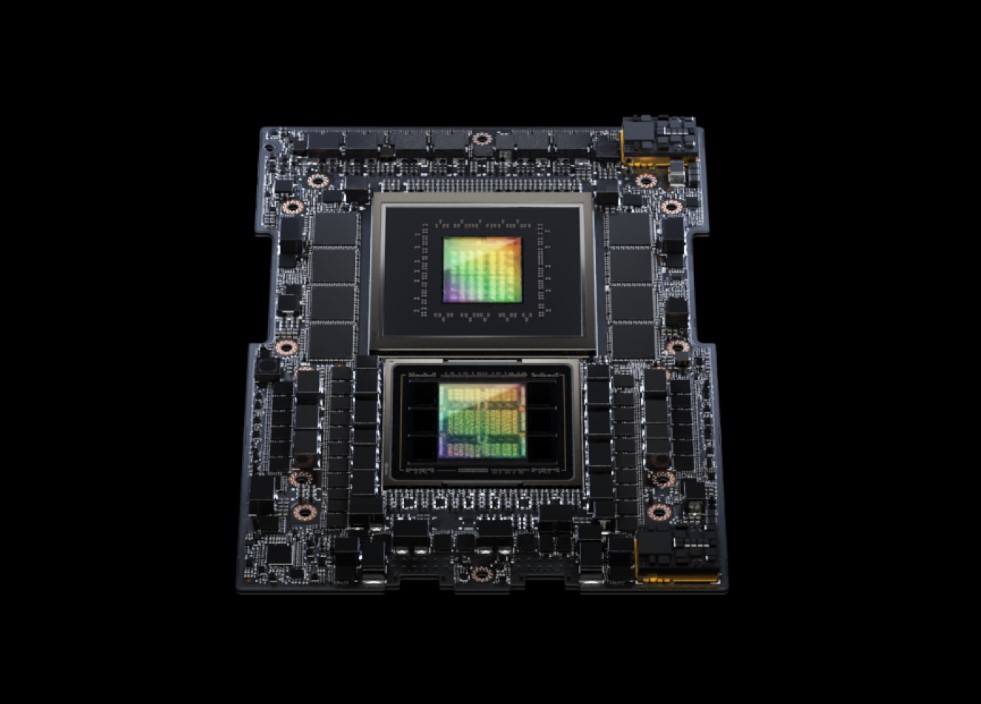

NVIDIA is massively accelerating their Data Center roadmap, now operating on a yearly cadence instead of two years. In 2024 there will be B100 replacing the H100. In 2025 X100 is going to replace both. GB200 and GX200 are going to be the Grace CPU/GPU variants replacing GH200.

www.servethehome.com

www.servethehome.com

NVIDIA Data Center Roadmap with GX200NVL GX200 X100 and X40 AI Chips in 2025

NVIDIA showed its AI GPU roadmap with the NVIDIA X200, GX200, GX200NVL, and X40 chips set for launch in 2025, 2.5 gens ahead of today's chips

Full official Nvidia presentation at the link below:NVIDIA is massively accelerating their Data Center roadmap, now operating on a yearly cadence instead of two years. In 2024 there will be B100 replacing the H100. In 2025 X100 is going to replace both. GB200 and GX200 are going to be the Grace CPU/GPU variants replacing GH200.

NVIDIA Data Center Roadmap with GX200NVL GX200 X100 and X40 AI Chips in 2025

NVIDIA showed its AI GPU roadmap with the NVIDIA X200, GX200, GX200NVL, and X40 chips set for launch in 2025, 2.5 gens ahead of today's chipswww.servethehome.com

They are killing the competition to the point that AMD cancelled MI350 and on top of that, NV already booked most of CoWoS capacity for the next 2 years (some factories like TSMC CoWoS plant in Zhunan is 75% for Nvidia), leaving no option than letting the competition fighting for the scraps. Right now, NV have globally more than 20 billion dollars in firm purchase commitments with its supply chain. They are full in DC/AI and they put immense cash flow to secure total dominance...

Full official Nvidia presentation at the link below:

They are killing the competition to the point that AMD cancelled MI350 and on top of that, NV already booked most of CoWoS capacity for the next 2 years (some factories like TSMC CoWoS plant in Zhunan is 75% for Nvidia), leaving no option than letting the competition fighting for the scraps. Right now, NV have globally more than 20 billion dollars in firm purchase commitments with its supply chain. They are full in DC/AI and they put immense cash flow to secure total dominance...

If data center demand keeps up they will do well. Still very unclear how much juice there actually is in this AI investment cycle. All of their other business lines are looking anemic including gaming.

D

Deleted member 2197

Guest

3 Red Flags for Nvidia's Future

October 12, 2023

October 12, 2023

1. Intel is seeing growth in the GPU market

AMD and Intel both produce their own x86 CPUs, so integrating GPUs into those chips could eventually push Nvidia -- which doesn't make its own x86 CPUs -- out of the PC market. According to JPR, Nvidia's share of the entire GPU market (including discrete GPUs and iGPUs) held steady year over year at 18% in the second quarter of 2023. However, AMD's share dropped from 20% to 14% as Intel's share grew from 62% to 68%.

In the iGPU market, Intel's share grew from 78% to 84% as AMD's share dropped from 22% to 16%. That growth is worrisome because Intel doesn't only produce low-end iGPUs anymore. Intel actually rolled out its own Arc discrete GPUs over the past 17 months, and its upcoming Meteor Lake mobile processors will reportedly include an iGPU that provides comparable performance as Nvidia's mid- to high-end discrete GPUs.

Nvidia still controlled 87% of the discrete GPU market in the second quarter of 2023, according to JPR, compared to AMD's 10% share and Intel's 3% share. But if Intel plays its cards right and continues to roll out new Arc GPUs and iGPUs, it could chip away at Nvidia's base of PC users and curb the growth of its gaming business.

2. Microsoft and OpenAI are developing their own AI chips

However, a recent report from The Information claimed Microsoft could soon unveil its own first-party AI chips to cut costs and reduce its long-term dependence on Nvidia. Another Reuters report claimed OpenAI was mulling the development of its own AI chips for similar reasons.

The development of those first-party chips wouldn't be too surprising, since Alphabet's Google, Meta Platforms, and Amazon are all reportedly developing their first-party AI chips. But if Microsoft and OpenAI also hop aboard that bandwagon, investors should wonder if Nvidia will still produce the default GPUs for accelerating AI tasks in the future.

3. The government expanded export curbs on its AI chips

But this August, the Biden administration tightened those rules to block U.S. investments in Chinese chips, quantum information technologies, and AI. In its latest 10-Q filing, Nvidia also revealed that the U.S. government had introduced new licensing requirements for all exports of A100 and H100 products from "some countries in the Middle East" to other overseas markets like China and Russia. Those tightening restrictions could throttle the overseas growth of its data center business.

Yeah it's a good question. And the genuine answer is that we are at the early beginning of this investment cycle. AI, like it or not, will be applied in every layer of our society, both in private and corporate. Right now, it covers maybe only 1% of what its possible to do (for the good or the bad some will say... cough... skynet... cough)If data center demand keeps up they will do well. Still very unclear how much juice there actually is in this AI investment cycle. All of their other business lines are looking anemic including gaming.

TBH at this time the biggest issue on the negative side is the built-in bias in the AIs, Skynet is a bit further into the futureRight now, it covers maybe only 1% of what its possible to do (for the good or the bad some will say... cough... skynet... cough)

D

Deleted member 2197

Guest

Nvidia's Jensen Huang tops "most popular CEOs" survey, check out the best and worst approval ratings

Professional social network Blind carried out the survey to determine the approval rating of 103 CEOs, based on employees' feedback in August 2023. The network asked workers:...

www.techspot.com

www.techspot.com

In a nutshell: It's not uncommon to find the most successful companies led by the most unliked bosses, but there are exceptions. According to a new survey of 13,171 verified US professionals, Nvidia CEO Jensen Huang has the highest approval rating (96%), while Apple chief executive Tim Cook also made the top five. The list includes CEOs with the lowest approval ratings, too: Western Digital's David Goeckeler came in joint last with an approval rating of 0%.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 396

- Replies

- 84

- Views

- 6K

- Replies

- 375

- Views

- 28K

- Locked

- Replies

- 260

- Views

- 22K