No, I'm saying that companies like TSMC will take advantage of how extremely reliant they are and costs will go up, whether Nvidia likes it or not.

TSMC costs are going up regardless of what Nvidia does or if it even exists. This isn't in any way related to AI demand.

At that point, Nvidia will need to raise prices if they want to continue making money off gaming GPUs.

Nvidia has essentially never "raised prices" on their GPUs and I don't see why that would change. For this to happen some product must be on the market long enough to be affected by inflation while simultaneously somehow being not affected by production improvements (even the newest processes become cheaper with time) and not having any competition which would prevent such price change.

When people say that "Nvidia raised prices" what they really mean is that they arbitrary take two different products from Nvidia made some years apart on completely different production lines and likely even on a different architecture and then compare their prices based on the fact that both of these products have "8s" in their names. Or "7s". Which is a completely pointless comparison no one should be making ever.

What you're suggesting is that Nvidia would stop selling new GPUs (as in some future products; 50 or 60 series) in a lower pricing range where they sell them now. This isn't really "raising prices" because this alone doesn't mean that perf/price will actually degrade in future products because of that but even if we entertain such idea as a possibility the only valid reason why it could happen would be monetary inflation compensation - i.e. something which isn't related to Nvidia or TSMC or anyone in the business. A 3080 sold at $600 in 2020 should cost $724 now to provide the same profit margin due to US inflation alone. A 3060 sold in 2021 at $330 should be $380 now. Adjusted for inflation a 4060 sold at $300 in 2024 would've cost $260 in 2021, this is pretty much the price of 3050 back then.

I can't think of other reasons why lower end pricing range would become unnecessary. Sure there are some fast iGPUs incoming but even with that the need for a small GeForce will remain for some time as people may actually prefer Nvidia to other IHVs - or even prefer dGPUs regardless of how fast an iGPU may be in some APU. The only way Nvidia would leave that pricing segment is if there wouldn't be any demand for discrete videocards at that price point.

Yes, they will shift and change their capacities to demand.... that's exactly the point. Less and less of a priority on gaming GPUs. Costs go up.

TSMC doesn't make any distinction between gaming or non-gaming chips on its lines. The only distinction which they care about is how complex these chips are which in turn determines how much they cost in production.

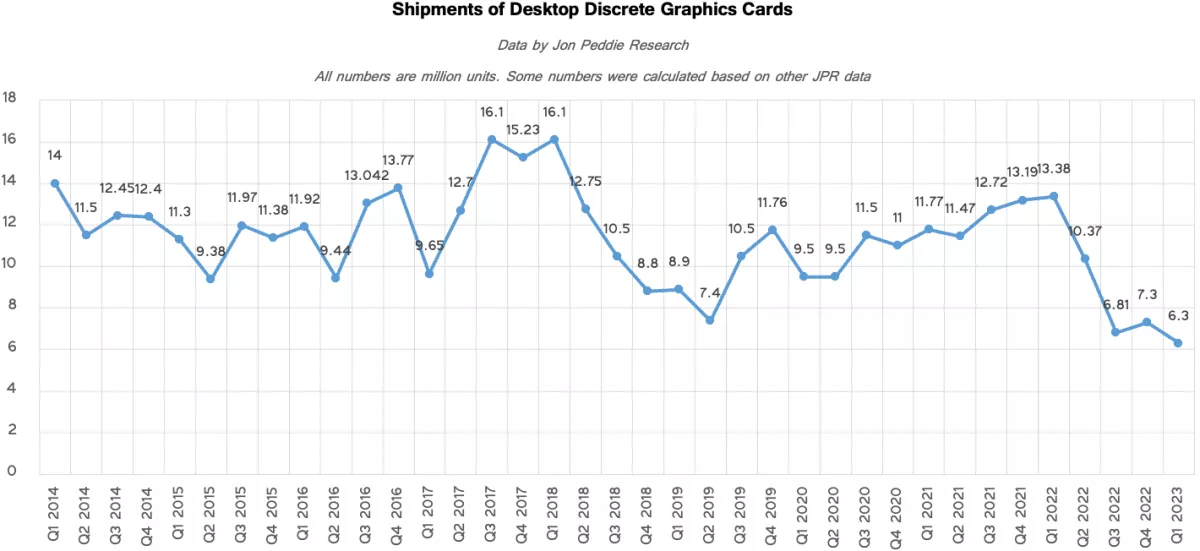

22Q4/23Q1 is "crypto hangover", the peak before that is driven by mining demand (just as 17Q3-19Q2 period).

If you adjust for that you'll notice that the sales are basically at the same level - which is what more recent Nvidia financials suggest as well.

Because the more pressure put on the semiconductor industry will result in increased costs to produce gaming GPUs.

No it won't. Gaming GPUs aren't being produced on the same scale or even same factories. You may just as well suggest that AI h/w demand will prevent production of all other chips on the planet - this would be just as weird of a suggestion.

They'll push the limits with what they can charge.. since they will no longer be dependent on gaming GPU sales.

You don't "push the limits of what you can charge" if you're "greedy". You take control of the market and get profits from savings on scale of production. What you suggest is essentially stupid business decision which would simply kill off your business and leave you without one. Nvidia is not stupid.

Not even sure what you're trying to say here. How does Nvidia "being present" in those markets translate to Nvidia being GOOD for those markets? This is the problem. I never said Nvidia would just up and leave the market... I said this AI shit is creating the conditions to which the gaming market will no longer be able to afford Nvidia. There's a difference there...

How does a company being "good" for a market? That makes zero sense. A company is making a product for some market with the intent of making a profit from selling this product. This is the only thing a company does on a market and there are no "good" or "bad". If a company suddenly decides to sell their products at X2/3/5/10 of their previous prices on the same market for no reason it loses the market because either all sales go to competition or sales just stop as the market has a size and that size is generally finite. If you're selling 10 GPUs for $100 and then suddenly the same GPU starts to cost $1000 you're now selling 1 GPU - and your competition takes 90% of your market. Market, how does it work.

Anyway. What you're suggesting won't happen. AI h/w demand won't (doesn't actually, we're living in this moment for a year now) affect gaming market - or Nvidia products retail pricing. These markets are not at all connected (mining was which is why it was a big problem which Nvidia tried to fight with LHR GPUs btw which is the opposite of what you're suggesting they'd do now), neither in consumer space nor in production one. Next generation prices may "rise" but only to cover the gains in USD inflation we've got since COVID. They will remain similar otherwise and we'll see if anyone but Nvidia will be able to dictate prices in the coming launches. Hasn't really been the case since uh I dunno RV770 vs GT200?