What do we think? Perhaps it is time to rename Jensen to Neo because he sure knows how to dodge bullets. The rumored three-month delay in shipping Blackwell to its major customers—hyperscalers like Amazon, Meta, and Microsoft—proved to be a false alarm. A three-month delay is minor in the grand scheme of things, but given the expectations of Nvidia to produce, investors and analysts would’ve been running around like their hair was on fire had the delays come true.

...

“Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories achieving significant scale, demonstrating that Nvidia is a full-stack and data center-scale platform,” said Jensen Huang, founder and CEO of Nvidia, in a statement.

...

Kress went on to say demand for Nvidia products is coming from model makers, consumer Internet services and “tens of thousands of companies and start-ups building generative AI applications for consumers, advertising, education, enterprise, health care, and robotics developers.”

Nvidia may be known for its graphics, but its networking products are taking off at a rapid clip. Networking revenue increased 16% sequentially, and, in particular, Nvidia’s Ethernet for AI revenue, which includes Spectrum-X and an Ethernet platform, doubled sequentially, with hundreds of customers adopting Nvidia’s Ethernet offerings, Kress added.

Nvidia plans to launch new Spectrum-X products every year to support demand for scaling compute clusters, and Kress said Spectrum-X is well on track to becoming a multibillion-dollar product line within a year.

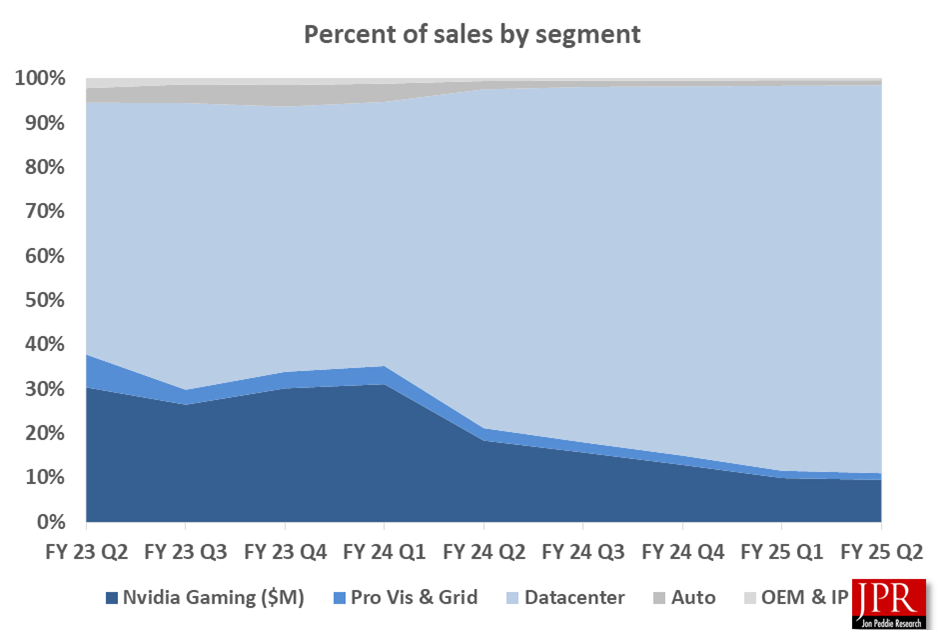

Second-quarter gaming revenue was $2.9 billion, up 9% from the previous quarter and up 16% from a year ago. No new cards were shipped, but there was a lot of software activity. First up was the announcement of Nemotron-4 4B, a small language model for on-device inference for Nvidia ACE, a suite of generative AI gaming technologies.

In the quarter, the company said it surpassed 600 RTX games and apps to over 600 and over 2,000 games on GeForce NOW.

The second-quarter revenue for professional visualization was $454 million, which is up 6% from the previous quarter and up 20% from a year ago. In the quarter, the company introduced generative AI models and NIM microservices for OpenUSD to accelerate workflows and develop industrial digital twins and robotics.

In the automotive and robotics segment, the second-quarter revenue was $346 million, up 5% from the previous quarter and 37% from a year ago. During the quarter, world leaders in robot development, including BYD Electronics, Siemens, and Teradyne Robotics, said they are adopting the Isaac robotics platform for R&D and production.